Many of the world’s most well-known businesses, from Starbucks to Apple, began in the United States. These companies began as start-ups before establishing themselves as industry heavyweights. On the other hand, the commercial world is never as straightforward as it appears. Even though a business is founded in the United States, it is not required to remain there in perpetuity. As you may be surprised to find, many of these companies are no longer American. Numerous businesses, including IBM, Ben & Jerry’s, and even Holiday Inn, profit from foreign investment. Numerous businesses would have been forced to close their doors had they not acted in time.

Companies That We Believed To Be American, But They Are Really Not!

General Electric

When General Electric began operations in 1982, it was a relatively young corporation. Despite this, its popularity has increased since then. It has since expanded its operations into a variety of other sectors, including healthcare, aviation, venture capital, and even renewable energy. Due to the “Made in America” stamp on the products, this is one of those companies that makes you feel as if you’re shopping at a neighborhood store. However, the truth is that Haier, a Chinese corporation, has been the company’s majority shareholder since 2016. To put this in context, it costs $5.4 billion to acquire GE. While the products are still manufactured in the United States, the decisions are still made in China.

General Electric

AMC

For over a century, AMC theaters have given moviegoers delightful and easygoing moviegoing experiences. Due to their success, this firm grew to become the world’s largest movie chain. Despite the notion that the initials AMC stood for American Multi-Cinema, the majority stakeholder from 2012 to 2018 was a Chinese company called Dalian Wanda Group. After Silver Lake Partners acquired a $600 million investment in it in 2018, the company’s fortunes shifted slightly. This does not alter the reality that Wanda Group retains final control over executive-level appointments.

AMC

Budweiser

According to some, you cannot get more American than this when it comes to beer. Despite the fact that it was founded in Missouri and the container continues to read “America,” this firm is no longer American. InBev, the Belgian beer behemoth, acquired this company for $52 billion in 2008. While it may have had a strong American identity in the past, it is a totally different place in the present and future. Whatever the case may be, we’re relieved that the parent company retained control of the formula. It retains its original flavor!

Budweiser

Ben & Jerry’s

This ice cream manufacturer has developed a reputation as a cultural icon through the years. In the United States, Ben & Jerry’s ice cream is so well-known that it has been featured in countless television series and films. In 1978, Jerry Greenfield and Ben Cohen, two Vermont friends, established the ice cream business. Unilever acquired it for a cool $326 million in 2000, and everything changed. The firm with its headquarters in London outbid two other potential bidders for the ice cream maker. This action increased Unilever’s portfolio, indicating that it was a wise investment.

Ben & Jerry’s

Burger King

When the majority of people envision fast food, they envision it in the United States. Burger King is one of numerous independently owned and operated franchises. In 1954, with the assistance of a business partner, David Egerton and James McLamore opened the first “Insta Burger King” in Miami, Florida. They had no idea it would grow to be a global brand. They eventually chose to exit the firm after ten years. It was afterwards held by a number of different individuals. Currently, Restaurant Brands International, a Canadian firm, owns it. BK is still financially backed by 3G Capital of New York.

Burger King

Trader Joe’s

Convenience shops have always been a highly competitive industry with a large number of companies. This is especially more true in densely populated places. In 1967, a shopkeeper named Joe Coulombe attracted customers away from 7-Eleven in Monrovia, California, by carrying unusual and exotic goods. His strategy had been successful. In 1979, despite the fact that the company had become a household name, he sold it. Theo Albrecht, the founder of Aldi Nord, a big German grocery chain, has acquired majority ownership of the company. He is estimated to be worth approximately $16 billion as a result of his family’s wealth. Whoa.

Trader Joe’s

Lucky Strike

According to my study, Lucky Strike is the most popular cigarette brand in the United States (commonly known as Luckies). In the 1930s and 1940s, people smoked the product due to the company’s excellent marketing campaign at the time. As a result, the brand rocketed to the top of the tobacco industry’s sales charts. Business relations with British American Tobacco began in 1976, when the two firms established their first relationship. In 1994, it acquired the American Tobacco Company, as well as two of the company’s subsidiaries, Lucky Strike and Pall Mall. Despite multiple alterations, it is still considered a uniquely American brand. This is owing to the fact that it is popular in popular culture. Mad Men made numerous allusions to this company.

Lucky Strike

American Apparel

The slogan “Made in the USA — sweatshop-free” drew people to American Apparel. It was a wonderful idea to encourage ethical shoppers to support the LA brand. Until 2015, the company performed admirably but has since battled to regain its footing. Gildan Activewear, a Canadian multinational, purchased the name and manufacturing equipment rights two years later for $88 million, rescuing the company. We’re not sure if American Apparel would still exist today without this. If you take a literal approach, the company’s headquarters remain in the Americas.

American Apparel

7-Eleven

Every successful firm began with a visionary founder. 7-Eleven was no exception. Jefferson Green, a regular Joe, spotted an opportunity to extend his product line while working at Southland Ice in 1927. He expanded his product line to include bread, eggs, and milk. He was a kind man. That business strategy was effective, and his Dallas-based company expanded even further once he changed the name to 7-Eleven to reflect the store’s operating hours. It remains a staple of American popular culture decades later. When the economy crashed in 1987, it entered a difficult period. This is where Ito-Yokado, a Japanese company, came to the rescue. This is why Seven & I Holdings acquired it.

7 Eleven

Sunglass Hut

Sunglass Hut is a famous shopping destination in the United States for many eyewear enthusiasts. The brand offers both colored and clear glasses. South Africa, India, the United Kingdom, and other countries are all represented. Despite this, Sanford Ziff, an optometrist from Miami, Florida, created the company. In 1986, five years after opening its 100th store, the company was sold. Luxottica acquired it for $653 million in 2001. When I was a child, there were approximately 1,300 stores located across the city. Almost 2,000 sites are currently open worldwide.

Sunglass Hut

Motorola

Motorola, well known for its electronic products, began in Schaumburg, Illinois, long before mobile phones existed. It developed progressively in popularity following its 1928 debut, reaching a zenith of success with flip phones and comparable devices. Google eventually acquired it, only for Lenovo, a Chinese corporation, to repurchase it in 2014. Google lost money on this transaction, having acquired the company for $12 billion two years prior to selling it for $2.9 billion. Even now, the mystery surrounding Google’s willingness to lose $10 billion on this deal continues.

Motorola

Ironman

The Ironmen race was founded by the Hawaii Triathlon Corporation. Dr. James P. Gills purchased it for $3 million in 1990. It has since expanded into a much larger company. Providence Equity Securities acquired the company for $85 million in 2008. Seven years later, the Dalian Wanda Group acquired it for $650 million! According to reports, the Chinese business was forced to assume a portion of the previous owner’s debt in order to close the sale. While the business was already profitable prior to its current configuration, Wanda was pleased with the 40% year-over-year net growth.

Ironman

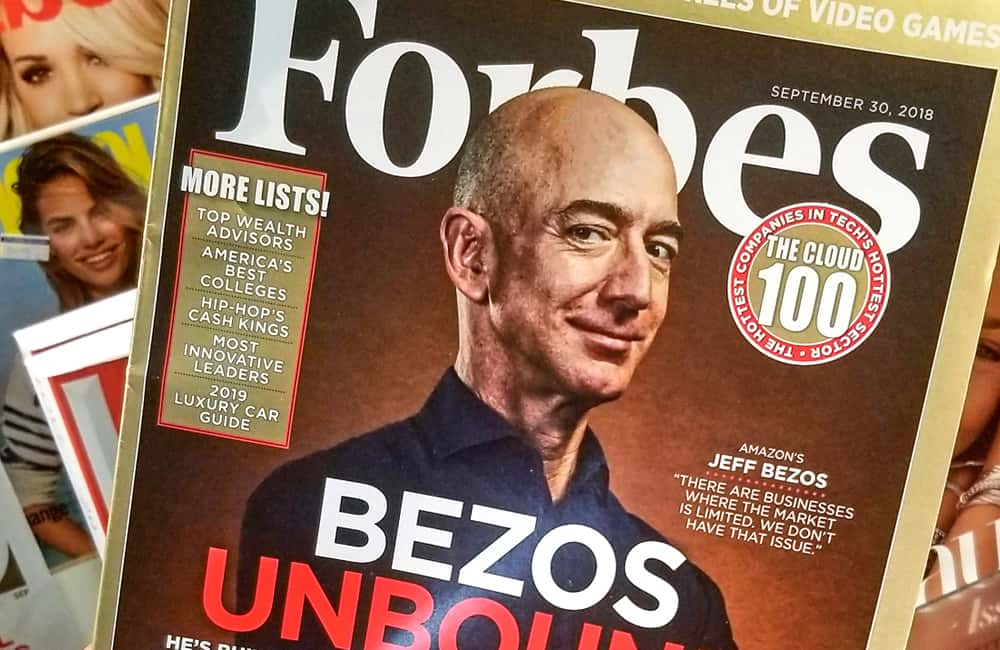

Forbes

Forbes published its first issue in September of that year. Isn’t it remarkable that 103 years have gone since then? Since since, it has developed a reputation as a trustworthy source for credible celebrity and business rankings. Two well-known lists to use as a starting point for your research are the World’s 100 Most Powerful Women and 30 Under 30. While many believe it is an American publication, it is really owned by Hong Kong-based Integrated Whale Media Investments. It paid $400 million for Forbes in 2014. However, we believe that readers have not seen anything different since the agreement was reached and prior to that as well as subsequent to that.

Forbes

Dirt Devil

For more than a century, Dirt Devil vacuum cleaners have kept American homes clean. The piece was developed in 1905 by Philip Geier of Cleveland, Ohio. The product range has expanded greatly since then, with over 25 million units sold globally. This is largely due to the singularity of the Cyclone system. Despite the fact that the corporation’s headquarters remain in North Carolina, Techtronic Industries, a Chinese multinational, owns the company completely. Dirt Devil purchased Hoover a few years ago, and the company now owns both of these household appliance names. It is evident that the Hong Kong-based business has expanded its appliance investment portfolio!

Dirt Devil

Good Humor

It’s no secret that baby boomers adore Good Humor ice cream. This company has operated ice cream trucks for over a century. When it was brought to Ohio in the 1920s, it was an instant hit. Thomas J. Lipton of Unilever acquired the business in 1961. It’s difficult to deny that Good Humor’s fortunes have improved since Lipton acquired the British-Dutch company’s US business. Since then, the company’s product line has expanded to encompass an increasing number of things, and it has maintained a loyal following among consumers nationwide.

Good Humor

Popsicle

Wait till you discover this company’s incredible history! When an 11-year-old Oakland, California child accidentally left his drink outside overnight with a stick in it, he came up with the Popsicle recipe. Later, when he returned to get it, he discovered that the water within had frozen solid. When Francis Epperson was an adult, he exposed it to the world. Joe Lowe acquired the song’s rights after it became an instant hit for him. Afterward, the man expressed regret for his action and recognized that he had changed for the worse in the intervening years. The popsicle was acquired by Good Humor in 1989, while the company was still a subsidiary of Unilever. As a result, it is now a subsidiary of the English-Dutch parent company that owns the other brands.

Popsicle

Purina

Purina was founded in 1894 when George Robinson, William H. Danforth, and William Andrews began feeding farm animals. Inadvertently, their invention became a financial success. Despite the fact that Nestle is better renowned for its food than its pet food, it acquired Purina for $10.3 billion in December 2011. This decision was made as a result of the merging of Purina and Friskies PetCare, the company’s pet food division. Purina, on the other hand, remains an American and global household staple.

Purina

Firestone

Firestone Tires leaped at the opportunity to partner with Pirelli, an Italian multinational business. On the other hand, the arrangement did not feel right. This was a primary motivation for Firestone’s decision to sell to a Japanese company, Bridgestone Corp. The Japanese firm acquired it for $2.6 million, or $80 per share. As a result of this move, Bridgestone has risen to become the country’s second-largest tire manufacturer. “The Bridgestone offer advances our objective of increasing shareholder value and significantly improves employment security and development opportunities for the men and women employed by Firestone’s current operations,” a Firestone spokesman told the Los Angeles Times.

Firestone

Gerber

In 2007, Nestle announced its plan to acquire Gerber Products Company for $5.5 billion. As a result, the Swiss conglomerate now controls the majority of the infant food market. You may earn a lot of money in this industry. The company began in 1927, when Daniel Frank Gerber’s wife began manufacturing baby food for their daughter Sally. As soon as he came up with the marketing idea, they had five new products on the market. The company has come a long way since its humble origins in New Jersey.

Gerber

Citgo

Citgo established itself as a prominent marketer and refiner of fuels and other products in Oklahoma in 1910. Petróleos de Venezuela, a Venezuelan oil business, acquired half of it in 1986 and took over as parent company. Unfortunately, recent news has not been favorable to it. Hugo Chavez informed the world that Citgo was being sold because it was performing “poorly” and resulting in dwindling earnings. Rather than selling the property, they sold bonds. South America was experiencing a recession in 2013, the year this article was written. It was given to Russia as collateral for its debt, but the offer’s future is uncertain.

Citgo

IBM (PC Division)

This corporation, which began with IBM, has always sought to keep the United States on the cutting edge of technical progress. Back in the day, it was more concerned with business machinery than with computers. To put it mildly, IBM’s history is fascinating. Lenovo acquired Compaq Computer’s PC segment for $1.75 billion in 2004. Lenovo CEO Chuanzhi Liu stated at the time that he was “delighted” with the achievement because he served as the company’s founder and “founding father.” However, IBM CEO Sam Palmisano stated in a statement that today’s announcement strengthened the company’s ability to “capture the highest-value opportunities” in a rapidly evolving information technology sector.

IBM (PC Division)

Legendary Entertainment Group

After acquiring AMC and experiencing tremendous success in the film industry, Dalian Wanda Group decided to go all-in by purchasing a movie studio in 2016. Legendary Entertainment Group sold a $3.5 billion interest in the Chinese company. At the time, Dalian Wanda Group intended to absorb it into its existing assets. However, it was determined that the wisest course of action was to leave things alone. It’s time to evaluate LEG’s performance after four years of ownership. Jurassic World: Fallen Kingdom, Pacific Rim: Uprising, Kong: Skull Island, and Skyscraper have all been released since the acquisition!

Legendary Entertainment Group

Hoover US

When Hoover originally opened its doors in 1908, it established a reputation as a reputable American appliance maker. A corporation named after its founder, William Henry Hoover, has grown into a household name. Despite the fact that for a long period, everything stayed local, Techtronic Industries paid $107 million for it in 2006, and everything changed. Although the headquarters remain in North Carolina, the central office has moved to Hong Kong. The Chinese conglomerate is massive, employing more than 30,000 people and generating annual revenues of more than $7.7 billion dollars. Even if the corporation’s headquarters are no longer in the United States, it remains in capable hands.

Hoover US

Frigidaire

Frigidaire originated in 1918 as the Guardian Refrigerator Company in Indiana. While Alfred Mellowes and Nathaniel B. Wales had the vision, they lacked the financial resources necessary to carry it out. At this moment, General Motors’ William C. Durant intervened! His investment enabled the company to achieve its current status with the assistance of the other two. It was acquired by the White Sewing Machine Company in 1979 and remained in operation until today. Electrolux, a Swedish giant, purchased the company in 1986. Frigidaire remains a subsidiary of this corporation to this day, although it appears to be doing well.

Frigidaire

Strategic Hotels And Resorts

This hotel firm now operates 17 luxury hotels in the United States and one in Germany. Strategic Hotels and Resorts was created in 1997. Laurence S. Geller, the company’s founder, came up with the concept while working as a real estate speculator. A Chinese company, Anbang Insurance Group, was apparently interested in purchasing it for $6.5 million in 2016. Finally, it appears as though the arrangement was renegotiated in light of the insurance company’s $1 million discount on the hotel chain. This was partly due to the fact that one of the properties was unable to be sold. Due of its proximity to a navy installation, the US government prohibited it from proceeding.

Strategic Hotels And Resorts

Alka-Seltzer

Alka-Seltzer is one of the most recognizable and long-lasting brand-name medications in the world. To begin, Dr. Miles Medicine Company, now known as Miles Laboratories, began selling this antacid and pain reliever drink in 1931. After some time in American hands, the company was purchased by a German concern called Bayer in 1978. Bayer has a long history of collaborating with some of the most illustrious pharmaceutical businesses in the world. They worked on a joint attempt to enhance Levitra sales in 2004 using GlaxoSmithKline’s “Strike Up A Conversation” tag line.

Alka-Seltzer

The Chrysler Building

Many people were taken away when The Wall Street Journal reported on the Chrysler Building’s sale in 2019. After all, it was one of the most recognizable monuments in the city. However, it has not been in the possession of a US person in an extended period of time. A year later, the Abu Dhabi Investment Council acquired the company’s majority stake for $800 million. A decade later, an Austrian company called SIGNA acquired it for over $150 million. As soon as the news broke, it was extensively covered in financial newspapers worldwide as a big loss.

The Chrysler Building

General Motors

Isn’t it amazing to realize that General Motors is the largest automobile manufacturer in the United States? Due to its magnitude as one of the largest corporations in the industry on a global scale, it is an extremely tempting and lucrative enterprise. Despite the fact that Shanghai Automotive Industry Corp. does not own 100% of the corporation, it is financially dependent on the Chinese firm. The two companies created a joint venture in 1998. Customers may be unaware that SAIC sells vehicles under the General Motors name. In any case, SAIC and GM operate independently, with SAIC headquartered in Shanghai and GM in Detroit.

General Motors

Spotify

We can’t remember a time when we couldn’t instantly access our favorite music by touching a button. Spotify owes us a big debt of gratitude for making this possible! Listeners can now listen music from the business, which was founded in 2006 in New York. Although it started in Sweden, it has since gone worldwide. At the end of last year, Spotify and Tencent Holdings each acquired a 10 percent stake in the other. Spotify was able to access the Chinese market as a result of the joint venture, while Tencent expanded its offers. Prior to partnering with them, the streaming service struggled to gain traction in China.

Spotify

The Waldorf Astoria Hotel

The Waldorf Astoria Hotel is a good choice for anyone seeking luxurious New York City accommodations. It is not only a New York institution; it is a piece of American history as well. Although Hilton Worldwide manages the hotel, Anbang Insurance Group purchased it in 2014 for $1.95 billion. By charging such a high rate, it has become the most expensive hotel in recorded history. The Chinese company significantly renovated the hotel, transforming many of the hotel rooms into condominiums in the process. Even more American enterprises are on the insurance company’s shopping list. It considered Starwood Resorts as a possible takeover target.

The Waldorf Astoria Hotel

Tesla

Elon Musk, the mastermind behind Tesla, owns a 21.7 percent interest in the company, making him the largest stakeholder. For example, Tencent Holdings Ltd. is a significant shareholder in the company. To their amazement, they discover that the Chinese conglomerate is not limited to music. Tencent is the world’s largest creator and publisher of video games, as well as a significant player in social media. It even reported a $95.8 billion net profit in 2019. Their approach is crystal clear: they are doing everything correctly! We anticipate it will continue to grow in the future.

Tesla

Snapchat

Without Snapchat, we don’t believe the habit of adding wacky filters to our photographs would have taken off. Bobby Murphy and Evan Spiegel started the app in 2011 with no idea how big it would become. Snap Inc., Snapchat’s parent company, is currently valued at more than $20 billion. Tencent, a Chinese internet titan, increased its market share in 2017 through a partnership with Snapchat. In the hope of reaping a nice profit, this internet titan paid nearly $2 billion for a 10% stake in the social networking company. Apart from assisting with the development of augmented reality, Tencent also contributed technical expertise to assist Snapchat with its augmented reality capabilities.

Snapchat

Ingram Micro

Ingram Micro began as a small reseller of high-tech items in 1979. As a result of this, a multibillion-dollar company was founded. In the early 1990s, it was able to acquire Softinvest in Belgium. Ingram can now distribute HP products and further extend its market share. Ingram Micro was acquired by Tianjin Tianhai Investment, a subsidiary of the HNA Group, for $6 billion in 2016. As a result, it became one of the parent corporation’s top revenue generators. On the other hand, this expanded Ingram’s global reach.

Ingram Micro

Fidelity & Guaranty Life

Since its inception in 1959 in Des Moines, Illinois, Fidelity and Guaranty Life Insurance Company has assisted countless people in safeguarding their financial futures. As a result, the future of the company has been anything from certain. It was previously owned by Harbinger Group. However, the parent company made it available to the broader public in 2013. F&G piqued Anbang Insurance Group’s interest, which acquired it for $1.57 billion. Everything appeared to be going swimmingly until the Chinese company withdrew from the arrangement at the last minute. After a sudden change of plans, CF Corp acquired F&G for approximately $1.84 billion in 2017.

Fidelity & Guaranty Life

Universal Music Group

For any ambitious artist, a record deal with Universal Music Group would be a dream come true. It is one of the “Big Three” record labels, alongside Warner Music Group and Sony Music. UMG has been in the business of making music for nearly a century. While the firm has contributed to the growth of numerous domestic musicians, it is no longer entirely American. Vivendi, a French business, previously held the majority of the company’s capital, until Tencent acquired it in 2020. The corporation located in Shenzhen paid $33.4 billion for a 10% interest in the record label.

Universal Music Group

WeWork

As you’re probably aware, shared workplaces have grown in popularity in recent years. This arrangement is ideal for freelancers and start-ups. WeWork capitalized on this when it opened its doors a decade ago. It is currently responsible for 4 million square meters! On the other side, it encountered a funding crunch in 2016 and required additional funding. Legend Holdings Corp., based in Beijing, joined the corporation as a “new partner” and contributed approximately $430 million at the time. This investment is both strategic and obvious for us,” says Legend Holdings Corp. Chairman and CEO John Zhao.

WeWork

Segway Inc

Until the previous several decades, people believed that zipping around on two wheels was something out of a science fiction film. Segway Inc. has proved it in real life. In 2015, Ninebot, a Beijing-based corporation, acquired the transportation company for $80 million. Segway’s prospects have only increased since then, as the Chinese corporation has aided the company in establishing a deeper foothold in the information technology and robotics industries. Following an announcement in 2018 that it would relocate its production operations to China, the company relocated its headquarters to New Hampshire in 2019. However, it reiterated that the majority of production would continue to take place in Bedford.

Segway Inc

John Hancock Life Insurance

John Hancock Financial Opportunities is a brand that is used to market a variety of products. However, as everyone is aware, life insurance policies are the company’s bread and butter. Since its inception in Boston, Massachusetts, the company has operated continually. Manulife Financial, a Canadian company, acquired it in 2004. Rather of simply acquiring John Hancock, this new parent company chose to incorporate the John Hancock name into its own. Manulife Financial is a Canadian firm headquartered in Toronto with approximately 34,000 employees and 63,000 agents.

John Hancock Life Insurance

Sotheby’s

A New York City art broker expressed interest in a Chinese life insurance organization. Sotheby’s has operated in London since 1744. However, it did open a location in New York City prior to going abroad. The auction company Sotheby’s has a new majority shareholder: China’s Taikang Life Insurance Co. Ltd. It remained that way until 2019, when Sotheby’s was acquired by Patrick Drahi, a French-Israeli businessman. However, we have no idea what will happen to the 13.5 percent stake held by a Chinese insurance organization in the corporation.

Sotheby’s

The Barclays Center

The majestic Barclays Center is well-known to aficionados of both sports and music. In 2019, Joseph Tsai, a Taiwanese-Canadian business magnate, completed the acquisition of this storied property. Additionally, the Alibaba Group’s chairman acquired the NBA’s Brooklyn Nets. ‘With full ownership of the Nets and the Barclays Center, we will continue to give our fans with our vibrant style of basketball,’ Tsai declared at the time. Additionally, “We have made a big investment in Brooklyn, and it will be an honor to bring the best of the Barclays Center and its incredible entertainment to our neighborhood.”

The Barclays Center

Brookstone Inc

Brookstone Inc. originated in the mid-1960s as a mail-order business specializing in unusual and hard-to-find items. After a while, it expanded its product line to include alarm clocks, remote control toys, and so on. As of 2018, it operated 34 locations around the United States. However, in 2014, it suffered a financial setback and filed for bankruptcy. It’s fortunate that Sanpower and Sailing Capital, two Chinese corporations, purchased and saved it for $173 million. We are indebted to them for intervening in time to avert Brookstone’s bankruptcy. The public was relieved when the firm emerged from bankruptcy in July of that year.

Brookstone Inc

Dairy Farmers of America Inc

Who would have expected that the Dairy Farmers of America, with such a moniker, would be involved in China? While it may seem improbable, it is true! Inner Mongolia Yili Industrial Group and DFA teamed in 2014 to establish a new milk powder processing factory. New Zealand was afflicted by a drought at the same time that China’s milk output fell. This effectively cut off the country’s supply. As a result of the issue, the Inner Mongolia Yili Industrial Group expanded its global reach. Despite the fact that DFA is not a shareholder, the two companies have a good working relationship.

Dairy Farmers Of America Inc

Fab.com Inc

It is a fact that online design firms face stiff competition. Tencent Holdings has made a $1 billion investment in Fab.com Inc., formerly based in New York. Fab previously declared a desire to grow into the Asian market. According to CEO Jason Goldberg, there are ways to enter new markets with the assistance of strategic partners who can help mitigate risk and increase the likelihood of success. PCH International, a two-year-old organization, acquired the firm in 2015. It has since been reimagined as a wellness firm focused on yoga gear.

Fab.com Inc

The Cleveland Cavaliers

In 1970, with the support of corporate sponsors, the NBA’s first franchise was created. Following that, the Cleveland Cavaliers proceeded to grow in size. One of the investors was the Goodyear Tire and Rubber Company. They did, however, begin receiving investment from outside the country in 2019. Previously, through billionaire Jianhua, the Cleveland Cavaliers collaborated with the New York Yankees and other American sports teams. He purchased a 15% stake in the NBA team, according to media sources. There is no reason to panic, as foreign investment in sports clubs is not unprecedented. This is why LeBron James is so popular in China.

The Cleveland Cavaliers

Riot Games Inc

Riot Games is well-known to everyone who has ever played League of Legends, a massively multiplayer online game. It debuted in 2009 and immediately gained popularity, eventually becoming the company’s most popular product. Although Riot Games and Tencent have collaborated for a lengthy period of time, their connection peaked in 2015. The remaining shares of Riot Games were acquired by a Chinese corporation, which became Riot Games’ parent company. Prior to this, it possessed 93 percent ownership in the gaming company. As a result, we feel that the future evolution was predetermined in advance. Riot Games is valued an estimated $6 billion.

Riot Games Inc

Uber Technologies Inc

We can’t envision our life without Uber for the most part. By hitting a button on the app, users can summon a cab. Travis Kalanick and Garrett Camp conceived the notion in 2009. So much has changed in the intervening years! This multibillion-dollar company is now well-known both internationally and in the United States. Baidu Inc., a Chinese web corporation, invested over $600 million in 214 in the intention of supporting the company’s expansion in China. It was a win-win situation for all parties, as Baidu used the software to grow its own mobile payment company. We’re relieved that everything ended up working fine!

Uber Technologies Inc

OmniVision Technologies Inc

OmniVision Technologies Inc. and Will Semiconductor Co. Ltd. announced their collaboration a full year after they were created. They had already processed around $2.1 billion in trades by the time the scandal broke in April of this year. We don’t know anything about the transaction because it was conducted in secret. While this information is limited, we do know that OmniVision began communicating with Chinese investors in 2015. Around this period, two Chinese companies teamed up to acquire the California-based firm for $1.9 billion. Will Semiconductor Co. Ltd., an unknown Chinese firm, chose to acquire it. The public is still perplexed.

OmniVision Technologies Inc

Baby Trend Inc

This Fontana, California-based baby equipment manufacturer sells car seats, highchairs, and diaper pails. It continued to thrive after being acquired by a Chinese corporation called Alpha Group. According to a representative for Alpha Group, vice president Wang Jing remarked that the company was “excited” to create unique educational and entertaining items for infants and parents. “By acquiring Baby Trend, we will be able to use our existing experience in the baby and infant industry while expanding our distinctive technologies and intellectual property portfolio.”

Baby Trend Inc

University of Texas MD Anderson Cancer Center

Many people were perplexed in 2012 when a Beijing-based firm called Concord Medical services acquired a fifth of the University of Texas M.D. Anderson Cancer Center Proton Therapy Center. Even while the university’s ownership stakes were unaffected, the deal elevated the Chinese company’s profile. “Proton treatment has become a widely accepted form of radiation therapy,” Dr. Jianyu Yang noted. He serves as Concord Medical’s medical chairman and chief executive officer. Concord Medical wants to open and manage two proton centers in China. “This agreement enables us to learn from the world’s leading provider of proton therapy cancer care and to acquire critical knowledge and understanding of proton therapy center operations.”

University Of Texas MD Anderson Cancer Center

Hilton Hotels

Conrad Hilton founded Hilton Hotels & Resorts in 1919. If that is the case, it has been in operation for nearly a century! From a limited number of establishments, Hilton has grown to become a household name. It now manages 586 hotels in 85 countries. HNA Firm, a Chinese aviation, and shipping corporation, acquired a 25% stake in the hotel group for $6.5 billion in 2016. As a result, it became the largest shareholder in the corporation. Additionally, HNA acquired Carlson Hotels earlier that year in an attempt to join the hotel industry. Hilton had a market value of approximately $26 billion at the time it was acquired by HNA.

Hilton Hotels

Starplex Cinemas

The reality is that Starplex Cinemas never achieved the same degree of success in the United States that AMC did. After all, the United States has only 34 of them. Many people in the United States have never visited a theater, owing to the scarcity of theaters in many parts of the country. AMC Theaters acquired it for $175 million in 2015. On the sites, AMC Classics theaters were constructed. We already notified you that the Chinese corporation Dalian Wanda Group now holds a majority stake in AMC. By 2017, all Starplex theaters had been converted to AMC locations, and the firm had essentially ceased operations. In other words, both Dalian Wanda Group and AMC have acquired it!

Starplex Cinemas

California Grapes International Inc

This corporation was founded in San Jose, California. However, after China Food Services Corp. acquired California Grapes International Inc., the company’s fortunes began to shift. It was originally focused on wine distribution, but has now been largely forgotten. Neither party has disclosed the cost of the transaction. China Food Services Corp. was founded in 1992, but what does it accomplish specifically? According to their statement, they are “engaged in food and beverage marketing and distribution in Asia and the Middle East.” The company owns 100% of Gold Dragon Food & Beverage Import and Export Company of Hong Kong, Ltd.

California Grapes International Inc

Fisher-Price

This toy maker has been in operation since 1930. Although Fisher-headquarters Price’s are in the United States, the firm has a number of international relationships with vendors. Additionally, it maintains 11 facilities in China. Fisher-Price made headlines in 2007 as a result of Mattel, its parent company. According to a variety of media outlets, more than one million toys manufactured in those factories have been recalled. These goods appear to have contained a significant amount of lead. If this chemical is utilized, it may endanger the health of children. Bear in mind that the corporation’s primary focus is on toys for extremely young children, which makes this information all the more concerning.

Fisher-Price

Hush Puppies

This shoe manufacturer had its market debut in 1958. Wolverine World Wide, the company’s parent company, markets and licenses its products in 120 countries, including the United States. However, the shoes are manufactured in numerous facilities located throughout the world. The corporation was in serious peril until current chairman Geoffrey Bloom intervened in the mid-1990s. Despite the fact that the company’s headquarters and manufacturing plant are located in Rockford, Michigan, outsourcing manufacturing cuts costs. When the leather is tanned, it is treated with a leather preservative called Scotchgard to extend the life of the shoes. The shoes are manufactured in countries ranging from Brazil to Vietnam to China.

Hush Puppies

Gillette

Many people immediately think of Gillette when it comes to shaving razors. While some components of the blade are manufactured in China, the majority of the blade is built in the United States. By contrast, the razor’s entire componentry, including the cartridges, handles, and blades, is manufactured in the United States. Since the early twentieth century, Boston has had a manufacturing sector. As you can see on the website, though, demand for these things has increased, forcing the company’s expansion. Gillette established a manufacturing unit in Shanghai in 1992 to suit market demand. As a result, the company is now capable of producing 1 billion razors per year.

Gillette

Barbie

In 1959, Ruth Handler designed the first Barbie doll, kicking off the legendary Barbie brand. Even after six decades, collectors continue to flock to these dolls. According to Mattel, the company that manufactures them, 58 million dolls are sold each year. Thus, it is selling over a hundred dolls per minute. Mattel generates around $1.5 billion in annual net revenue. As many people assume, the United States never made Barbies. In Japan, the first one emerged in 1959, during the country’s post-World War II reconstruction. The world’s four remaining plants are presently located in China, Indonesia, and Malaysia.

Barbie

Huffy

The fact that the bicycle supply company has been in operation for over a century is quite remarkable. Although it is headquartered in Dayton, Ohio, it currently operates a number of regional offices throughout the country. Among the companies on the list are Gen-X Sports, Royce Union, Huffy Bicycle Co., and American Sports Design Co. George Huffman founded the corporation, which he named after his boyhood nickname. It closed two of its American operations and outsourced the remainder of the production a few years later, in late 1999. One is in Taiwan, and the remaining five are in China. They’ve been in Celina, OH since then to meet with their American colleagues.

Huffy

Oakley Sunglasses

James Jannard, the company’s creator, initially put $300 in Oakley. It’s incredible to consider how it has developed into the iconic sunglass brand that it has become. Luxottica, a Milanese conglomerate, had previously acquired it. Oakley’s headquarters, on the other hand, remain in Lake Forest, California. Twenty years after its 1975 founding, the company raised $230 million in an initial public offering. It has developed since then to incorporate ski goggles and chin protectors, among other items. Red Digital Cinema was founded in 2007 by James Jannard, the former CEO of the company, following the sale of the business.

Oakley Sunglasses

Converse

This Boston-based footwear firm was started in 1908 and is best known for its canvas high-tops. Due to the onset of World War II, the company was compelled to cease operations. Throughout the historical period, it manufactured military footwear. It resurfaced following the war with some of its characteristics intact. Things took a turn for the worse after Converse declared bankruptcy in 2001. Nike purchased the company in 2003 in order to keep it afloat. It was also manufactured in other nations, owing to a parent firm with several plants in China. Shoes are currently manufactured in four countries: India, China, Indonesia, and Vietnam.

Converse

Nike

Nike, as previously stated, has a large number of manufacturing sites situated outside the United States. According to reports, China produces one pair out of every five! Over 210,000 people are employed in the sporting apparel business as a result of contracts with 180 manufacturers located throughout the country. As a result, only Vietnam outperforms the United States in terms of Nike production. Additionally, the firm outsources manufacturing to Brazil, Japan, Sri Lanka, and Indonesia. Conversely, Nike has been striving to decrease its dependency on Chinese labor. While one in every three pairs was made in 2012, that figure has since fallen to one in every five. Conversely, Nike has never explained why this is the case.

Nike

Levi’s

If you’re looking for denim clothing to stock up on, go no further than Levi’s Jeans. The firm has annual net sales of $5.76 billion. In the 1960s, as the consumer base shifted away from blue-collar workers and toward other sectors, the company’s products became fashionable. In the early 1970s, the corporation went public. Since then, it has expanded to operate in more than 50 countries worldwide. Each and every item on this site was designed and manufactured outside of the United States. On the other hand, the 501 Jeans are still manufactured in a North Carolina plant.

Levi’s

American Girl

Another line of our dolls is a major seller in the United States! If you own any ancient or antique American Girl dolls, you may be due thousands of dollars. In 1998, Pleasant Rowland founded the Pleasant Company, which produced these dolls. Previously, these products were only available by mail order. Mattel purchased the brand in 1998 and increased the products’ appeal to a wider audience. Increased demand resulted in an increase in supply. Even if the dolls are still made in Germany, the books are still made in Wisconsin. On the other hand, their accessories are manufactured in China and shipped to Wisconsin for assembly.

American Girl

Chevrolet

Chevrolet’s primary selling point is that it is manufactured in the United States. While the vehicles are still built in Detroit, the components are manufactured in China. Chevrolet cars have more than 50% foreign-made components. Take the Chevrolet Silverado for example. On the other hand, just 46% are manufactured in the United States. Only 51% of Chevrolet Colorados are manufactured in the United States. Without a doubt, the Corvette is the most evocative of all things American. Except for nine countries, the automobile manufacturer sells its vehicles globally. They were popular in South Korea until 2011 when they were sold under the “Daewoo Motors” moniker.

Chevrolet

Radio Flyer

Radio Flyer, which is most known for its red toy wagon, is headquartered in Chicago. Additionally, toy horses and trikes, as well as various bicycles and tricycles, are available. It has been in operation for nearly a century and continues to be headquartered at the same location. In 2004, the toy industry promoted a Chicago brand. Despite their claims to the contrary, China is where they truly manufacture their tricycles and scooters. There are no major outliers, with the exception of the plastic red wagon, which has always been manufactured in Wisconsin. Radio Flyer commemorated its 80th anniversary by erecting the world’s largest wagon.

Radio Flyer

Craftsman

Craftsman tools are sold at a variety of home improvement stores, including Sears, Lowe’s, Walmart, and The Home Depot. Although it has facilities in the United States, it outsources certain manufacturing to China and Taiwan. This decision was taken by the parent company, which is currently controlled by Sears. In China and Taiwan, Apex Tool Group makes sockets, ratchets, and wrenches. On the other side, Craftsman has a relationship with a separate tool manufacturer, Western Forge. Because this corporation manufactures the tools in the United States, the products are manufactured in both Asia and the United States.

Craftsman

Samsonite

Jesse Shwayder founded this luggage company in 1910 in Denver, Colorado. It was forced to migrate after 91 years on the West Coast due to a change of ownership across the country. Samsonite’s corporate headquarters are currently located in Mansfield, Massachusetts. However, the overwhelming bulk of these products are manufactured in Europe and Asia! The corporation has activities in China, India, and Hungary. Around 40% of the company’s hard luggage is manufactured in Nashik, India. Not just in terms of production and employment, but also in terms of sales, this brand is massive in China! Indeed, contract manufacturers in Shanghai account for two-thirds of Samsonite’s Chinese sales.

Samsonite

Dell

Dell is one of the largest computer manufacturers in the world, and chances are you’ve heard of them. Despite Michael Dell’s efforts in the early 1980s, the company’s production activities have since been fragmented. They develop their own web servers in Austin, Texas, for their global customers. They chose to outsource production to countries other than the United States, despite the fact that the machines were formerly manufactured here. The firm now has operations in Brazil, China, Ireland, Malaysia, and Mexico. It is a custom fabrication company based in Limerick, Ireland. When it opened in 2000, it received considerable media attention. It is one of the largest manufacturers in Ireland, covering an area of 40,000 square feet and employs 23,000 people.

Dell

Smithfield

Smithfield Foods is the only source of pork-based products. This firm has been in operation since 1936, when it was formed by Joseph W. Luter and his son. The company expanded steadily until it had over 500 farms in the United States and was one of the market’s largest participants. It was acquired by WH Group for $4.72 billion in 2013. A Chinese company had never spent this much money in the United States before. Although the corporation is still headquartered in Smithfield, Virginia, executive decisions are made in Luohe, Henan.

Smithfield

Holiday Inn

Around 70 years ago, Holiday Inn began as a tiny motel between Memphis and Nashville. Kemmons Wilson had a wonderful idea during a traumatic road trip with his family. Wallace E. Johnson had previously partnered with him a year after he initiated the project. In the late 1980s, the Intercontinental Hotels Group acquired the hotel chain. Even now, new stores are opening across the country and around the world. IGH still owns it, indicating that it was a sound investment.

Holiday Inn

Motorola

Motorola, well known for its electronic products, began in Schaumburg, Illinois, long before mobile phones existed. It developed progressively in popularity following its 1928 debut, reaching a zenith of success with flip phones and comparable devices. Google eventually acquired it, only for Lenovo, a Chinese corporation, to repurchase it in 2014. Google lost money on this transaction, having acquired the company for $12 billion two years prior to selling it for $2.9 billion. Even now, the mystery surrounding Google’s willingness to lose $10 billion on this deal continues.

Motorola

Burger King

When the majority of people envision fast food, they envision it in the United States. Burger King is one of numerous independently owned and operated franchises. In 1954, in Miami, Florida, David Egerton and James McLamore opened the first “Insta Burger King.” They had no idea it would grow to be a global brand. They were allowed to exit the firm for the first time in a decade following that. It has since been owned by a variety of people. Currently, Restaurant Brands International, a Canadian firm, owns it. BK continues to get financial backing from 3G Capital, a New York-based investment business.

Burger King

Lucky Strike

According to my study, Lucky Strike is the most popular cigarette brand in the United States (commonly known as Luckies). In the 1930s and 1940s, people smoked the product as a result of the product’s strong marketing campaign. As a result, the brand rocketed to the top of the tobacco industry’s sales charts. British American Tobacco was the company’s first customer in 1976. In 1994, the UK corporation acquired the American Tobacco Company and its subsidiaries Lucky Strike and Pall Mall. Despite numerous alterations, it is still seen as a symbol of America. This is partly because of its appeal in popular culture. Mad Men made numerous allusions to this company.

Lucky Strike

Budweiser

According to some, you cannot get more American than this when it comes to beer. Despite the fact that it was founded in Missouri and the container continues to read “America,” this firm is no longer American. InBev, a Belgian brewer, acquired the company for $52 billion in 2008. While it may have had a strong American identity in the past, it is a totally different place in the present and future. Regardless of the scenario, we are happy that the parent company did not alter the recipe. It retains its original flavor!

Budweiser

Hellman’s

You’re undoubtedly familiar with Hellman’s mayonnaise! Even if you do not, there is a good possibility you have some in your refrigerator right now. As early as 1905, Richard Hellmann invented his own Dijon mustard recipe by adapting a French condiment for the American market. Because his clients adored it, he decided to market it independently. Best Foods acquired the company in 1932 and operated it for the next seventy years. Unilever acquired Hellman’s for $20.3 billion in 2000. This is quite good for a dip prepared in New York City!

Hellman’s